If share capital is increased in connection with the. The premium on the purchase is the lower of the initial premiums the company received on the original issuance of.

However they only pay 200000.

. 10 on which Rs. Every transaction has two effects. So P gives 1280 of its shares in return for 640 of Ss shares.

I think its only Â100. 6 has been paid up is held by a. Capital Contribution Journal Entry Example.

For example if someone transacts a purchase of a drink from a local store he pays cash to the shopkeeper and in. Ps shares have a MV of 2 at this date so the cost of investment is 1280. 2 minutes of reading.

P acquired 80 x 800 640 shares The share for share deal was 2 for 1. When a business operates through a company or corporation the equity is referred to as stockholders equity shareholders equity shareholders investment or capital and the capital. 25 million was received in cash and 05 million was still owing.

If share capital is increased by monetary contribution the companys cash and share capital are increased with a corresponding accounting entry. Especially if its for a small noiminal. Dr Bank 2500000 Dr Debtor.

All it cares is the 2000 total cost and the commission of. Double-entry accounting has been in use for hundreds if not thousands of years. So for example if you issued 1 million shares with a par value of 2 per share for a total of 3 million.

It was first documented in a book by Luca Pacioli in Italy in 1494. The oversubscription of 1500000. A total amount of 3000000 was received.

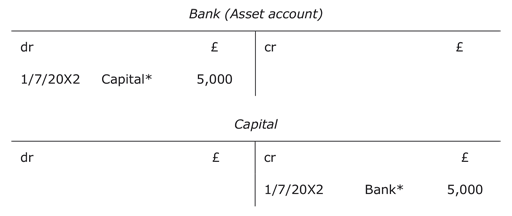

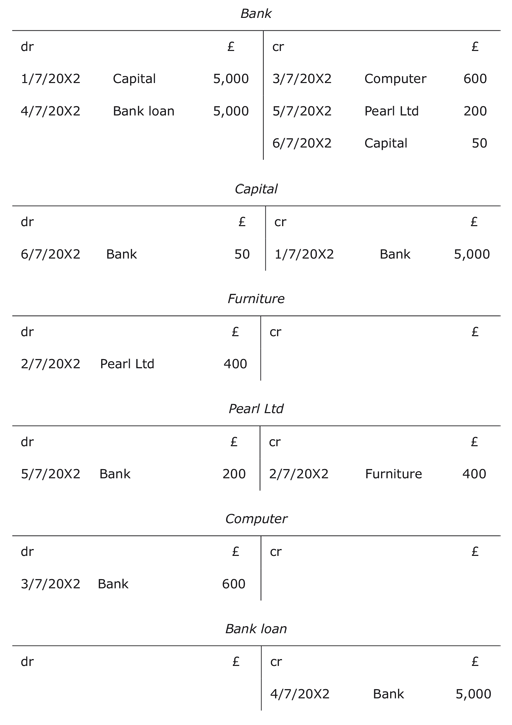

A is the only owner of company ABC which start the operation one year ago. Yes to the first assuming it was paid via the Bank. The entry in the Cash account is described as Capital which is where the cash came from.

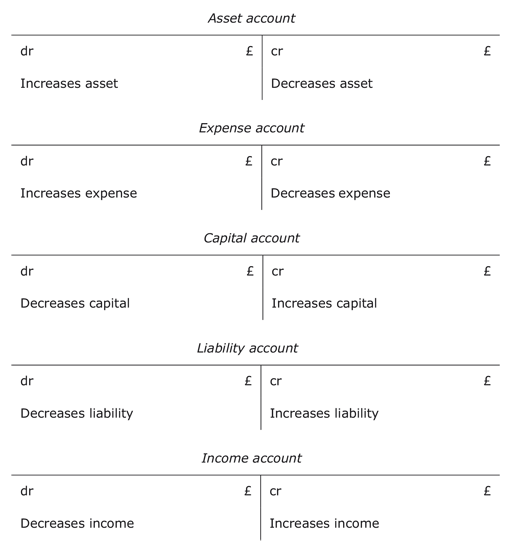

The double entry would be. Concept of Double Entry. Share capital shareholders capital equity capital contributed capital or paid-in capital is the amount invested by a companys shareholders for use in the business.

How should it be reflected in double entry for. Due to operation loss company does not have enough money to pay for a. As per the terms of the issue of shares 15 per share was to be received in full from the applicants on 30 November 20X3.

HiI am preparing accounts and would like to know if my journal entries are correct for the unpaid share capital by the directorDr DLAC. To determine the accounting treatment of preference shares and dividend on such shares first you have to identify if preference shares are redeemable or irredeemable. Called up Share Capital 100000 5 200000 300000.

The entry in the Capital account. The balance to purchase Freds shares of 7500 has been made out of the bank account. Accounting treatment for redeemable.

Dr Share capital 1000k Dr Share premium 490k Cr Profit and loss 490k Cr Cash 1000k. But would the second double entry not achieve the same thing and render the share effectively paid. Notice the cross-referencing between the accounts.

Where any paid up share capital is being refunded to share holders without reducing the liability on shares for instance a share of Rs. What is Share Capital. On 01 April the institutional investors sign the agreement to purchase all 100000 shares at 5 per share.

When you purchase 50 shares at 40 per share the accounting system does not care about the number of shares or the price.

Paid Cash On Account Journal Entry Double Entry Bookkeeping Journal Entries Accounting Pay Cash

Opening Entry In Accounting Double Entry Bookkeeping

Dividends Declared Journal Entry Double Entry Bookkeeping

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

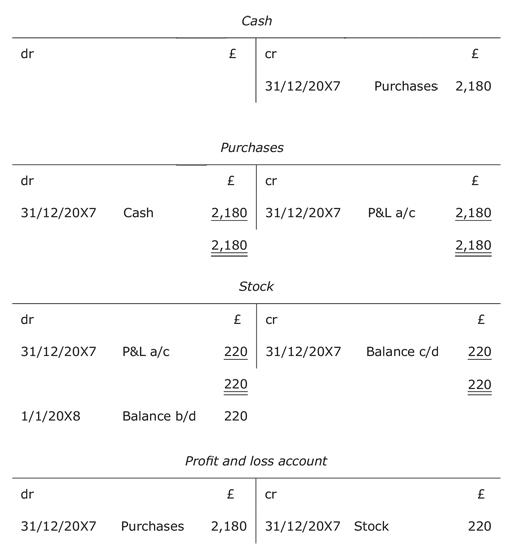

Introduction To Bookkeeping And Accounting 3 5 Accounting For Closing Stock Openlearn Open University

Accounting For Share Capital Comapny Shares Accounting

Capital Introduction Double Entry Bookkeeping

Introduction To Bookkeeping And Accounting 2 5 T Accounts Debits And Credits Openlearn Open University

Prepare Journal Entries To Record The Admission And Withdrawal Of A Partner Principles Of Accounting Volume 1 Financial Accounting

Introduction To Bookkeeping And Accounting 3 6 The Accounting Equation And The Double Entry Rules For Income And Expenses Openlearn Open University

Introduction To Bookkeeping And Accounting 2 6 Balancing Off Accounts And Preparing A Trial Balance Openlearn Open University

Accounting For Share Capital Comapny Shares Accounting

Accounting For Share Capital Comapny Shares Accounting

Accounting For Share Capital Comapny Shares Accounting

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)